What Does Tulsa Bankruptcy Filing Assistance Mean?

What Does Tulsa Bankruptcy Filing Assistance Mean?

Blog Article

The Best Guide To Top-rated Bankruptcy Attorney Tulsa Ok

Table of ContentsBankruptcy Attorney Near Me Tulsa Things To Know Before You BuyNot known Incorrect Statements About Tulsa Ok Bankruptcy Specialist Chapter 13 Bankruptcy Lawyer Tulsa - An OverviewThe Best Strategy To Use For Top Tulsa Bankruptcy LawyersThe Ultimate Guide To Experienced Bankruptcy Lawyer Tulsa

The stats for the other main type, Chapter 13, are even worse for pro se filers. (We damage down the distinctions between the two enters deepness listed below.) Suffice it to say, talk with a lawyer or more near you that's experienced with bankruptcy regulation. Here are a couple of resources to find them: It's understandable that you may be hesitant to pay for a lawyer when you're already under substantial financial pressure.Many lawyers also use complimentary assessments or email Q&A s. Benefit from that. (The non-profit app Upsolve can aid you discover totally free assessments, sources and legal aid absolutely free.) Inquire if bankruptcy is without a doubt the ideal option for your situation and whether they think you'll certify. Before you pay to submit bankruptcy forms and acne your credit record for up to one decade, check to see if you have any sensible choices like financial obligation negotiation or non-profit credit rating therapy.

Advertisements by Cash. We might be made up if you click this advertisement. Ad Now that you've decided bankruptcy is without a doubt the appropriate strategy and you with any luck cleared it with a lawyer you'll require to start on the documents. Prior to you study all the main bankruptcy kinds, you should get your own records in order.

The smart Trick of Tulsa Bankruptcy Lawyer That Nobody is Discussing

Later down the line, you'll really require to prove that by divulging all kind of details about your financial affairs. Here's a basic checklist of what you'll need on the roadway ahead: Identifying records like your motorist's certificate and Social Security card Income tax return (up to the past four years) Proof of earnings (pay stubs, W-2s, self-employed revenues, income from assets as well as any type of earnings from federal government advantages) Financial institution statements and/or retirement account declarations Evidence of value of your possessions, such as lorry and genuine estate valuation.

You'll want to recognize what type of financial debt you're attempting to resolve.

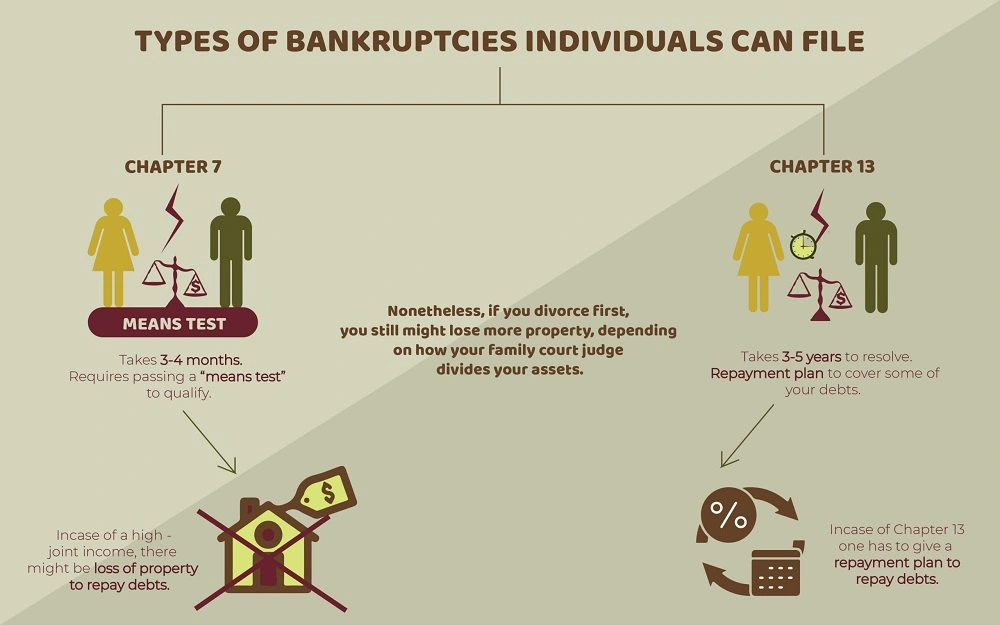

You'll want to recognize what type of financial debt you're attempting to resolve.If your revenue is expensive, you have another choice: Phase 13. This choice takes longer to fix your financial obligations due to the fact that it requires a long-term settlement plan usually three to five years before a few of your remaining financial obligations are wiped away. The filing procedure is additionally a great deal a lot more complicated than Chapter 7.

The Of Tulsa Debt Relief Attorney

A Chapter 7 personal bankruptcy stays on your credit history record for ten years, whereas a Chapter 13 personal bankruptcy diminishes after seven. Both have long-term impacts on your debt rating, and any type bankruptcy lawyer Tulsa of new financial obligation you take out will likely feature higher rate of interest. Before you send your bankruptcy kinds, you have to initially finish an obligatory course from a credit scores therapy agency that has been accepted by the Division of Justice (with the remarkable exception of filers in Alabama or North Carolina).

The course can be completed online, in person or over the phone. You must complete the course within 180 days of declaring for insolvency.

Chapter 7 Vs Chapter 13 Bankruptcy - Questions

Inspect that you're submitting with the appropriate one based on where you live. If your permanent home has actually relocated within 180 days of loading, you ought to submit in the area where you lived the greater part of that 180-day period.

Normally, your bankruptcy attorney will certainly function with the trustee, but you might require to send the individual records such as pay stubs, tax returns, and financial institution account and credit card statements directly. A common mistaken belief with bankruptcy is that once bankruptcy lawyer Tulsa you file, you can quit paying your debts. While personal bankruptcy can help you clean out numerous of your unsafe financial obligations, such as overdue clinical bills or personal fundings, you'll want to maintain paying your regular monthly settlements for guaranteed financial debts if you want to keep the residential property.

The Of Experienced Bankruptcy Lawyer Tulsa

If you're at danger of foreclosure and have exhausted all other financial-relief choices, after that declaring Phase 13 might postpone the foreclosure and conserve your home. Eventually, you will certainly still require the income to proceed making future home loan payments, along with settling any type of late settlements throughout your layaway plan.

The audit might delay any debt relief by numerous weeks. That you made it this far in the procedure is a suitable indicator at least some of your financial debts are eligible for discharge.

Report this page